Support

Support

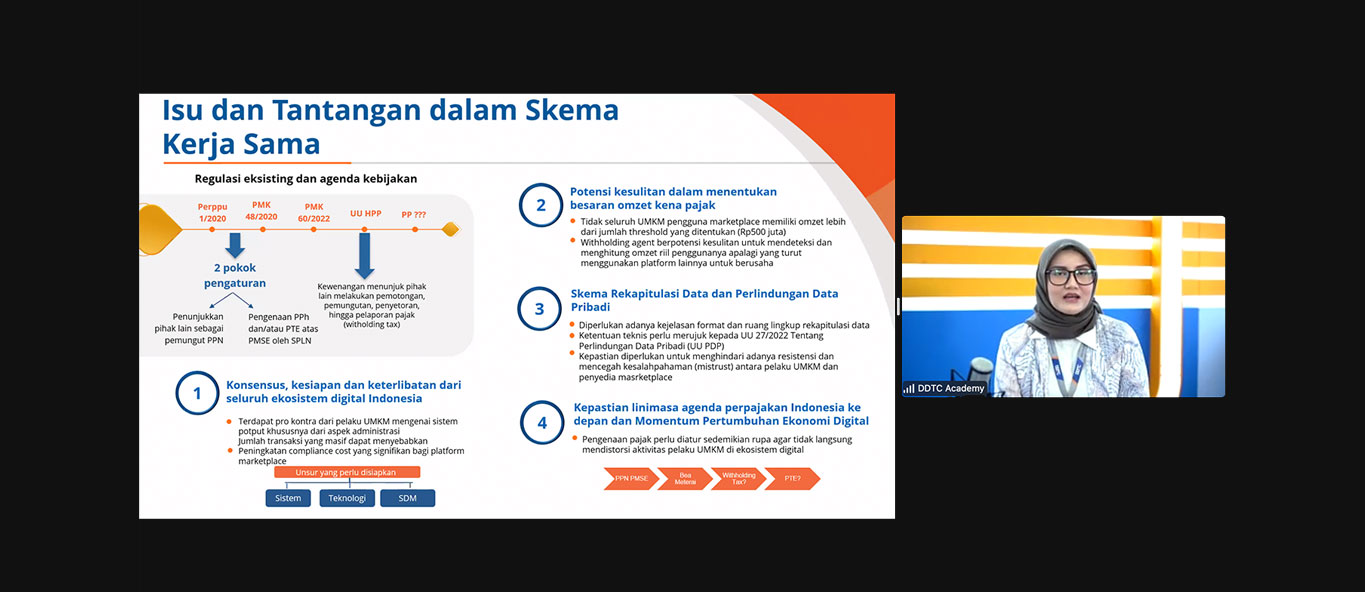

Webinar on Optimizing Tax Compliance of MSMEs in the Digital Sector: Challenges, Opportunities, and Recommendations

Known as the backbone of the Nation's economy, MSMEs consistently make a big contribution to the economy, even during a pandemic. It is estimated that 99% of business actors in Indonesia are MSMEs. However, based on figures released by the World Bank in 2021, the tax contribution from MSMEs is still far from what it should be, with MSME tax compliance rates ranging from only 15%.

To boost the MSME tax compliance rate, collaboration from various parties is needed. Seeing the number of business actors who are onboard to digital platforms, collaborating with digital platforms as MSME tax cutters is also one of the solutions sought.

Due to this urgency, DDTC Fiscal Research & Advisory held a Webinar on Optimizing Tax Compliance for MSMEs in the Digital Sector: Challenges, Opportunities, and Recommendations on Thursday, November 10. As a representative of the Association that oversees the digital ecosystem, Head of PPGR idEA Rofi Uddarojat was present as one of the responders on the agenda. On the occasion, Rofi said that the onboarding of business actors to digital platforms had made business actors who had been considered a shadow economy easier to detect. In order for these business actors to understand and comply with tax provisions, socialization and training need to be intensified.

Along with the webinar agenda, DDTC FRA also released a Policy Note containing policy reviews and recommendations on the implementation of MSME tax obligations in the digital ecosystem. You can download the Policy Note here.